When one thinks about worker wellbeing, the focus is mostly on physical safety, health benefits, and workplace conditions. But financial stability, one of the most personal aspects of wellbeing – is often overlooked. And yet, it reflects everywhere: in workers’ daily decisions, their stress levels, and their ability to focus at work.

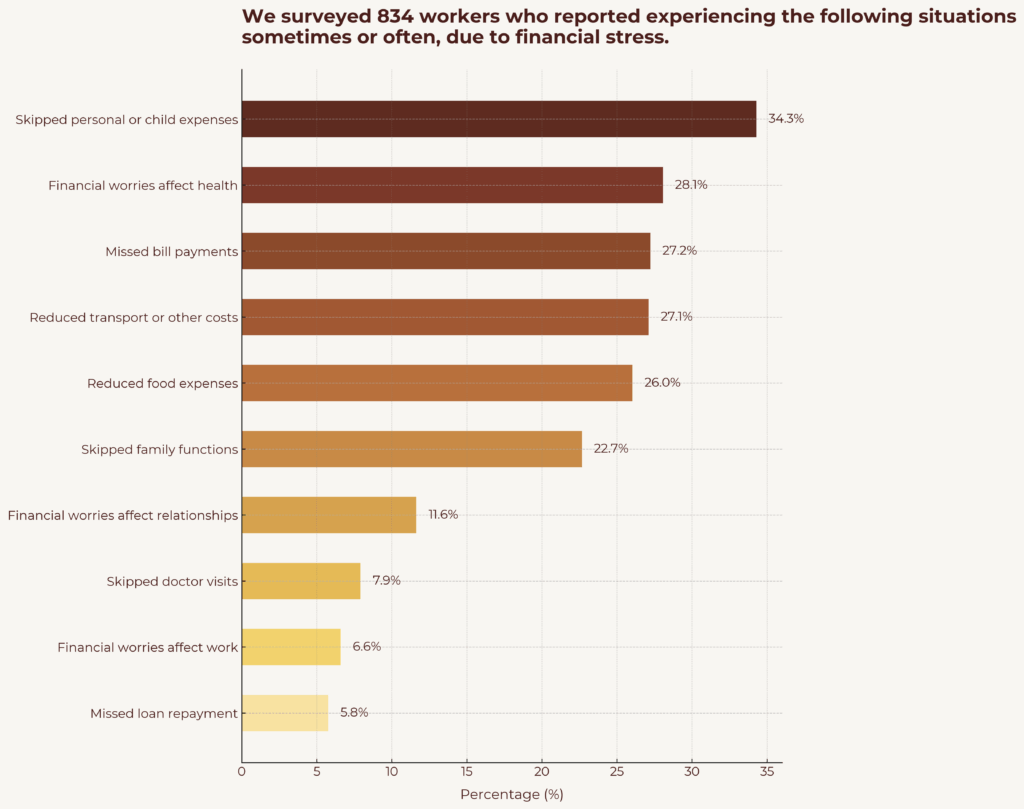

A survey of 834 workers found that 34% had to skip personal or child-related expenses because of financial strain. Around 27% missed bill payments, and a similar share had to cut back on food and transport costs. These financial pressures don’t disappear when workers start their shifts. They linger, affecting concentration, decision-making, and overall wellbeing.

According to PwC’s Employee Wellness Report, financially stressed employees are nearly five times more likely to say that personal finance issues distract them at work. This distraction isn’t just an individual problem—it becomes a workplace challenge, impacting productivity, engagement, and retention.

Despite this, many businesses may not fully realize how workers’ financial stress affects workers’ wellbeing at work and workplace outcomes such as higher absenteeism, lower productivity, or increased turnover. But, addressing this isn’t just about reducing business costs; it’s about acknowledging financial security as a key part of worker wellbeing.

How Financial Stress Takes a Toll

Financial stress plays out in deeply personal ways, shaping workers’ lives, decisions, and opportunities. The weight of financial stress isn’t uniform; it shifts based on the demographic, a worker’s background, household circumstances, and access to support.

For some, the pressure is immediate. A garment worker we spoke to needed ₹5000 for her mother’s treatment but had no savings to fall back on. When she called her relatives for help, no one answered. She ended up covering the cost on her own, juggling hospital visits with workdays.

Others are constantly planning ahead – saving for their children’s education, household needs, or cultural expectations like buying gold. Women in rural areas, especially those who are separated or widowed, often bear the entire financial responsibility for their families. Unlike married women who may have access to a second income, they must navigate financial independence with very few safety nets.

Our survey of 834 workers from the Earned Wage Access (EWA) project highlights the financial trade-offs they face including missed bill payments, skipped doctor visits, and cutting back on food, all of which impact their overall personal wellbeing.

Even day-to-day choices come with financial trade-offs. A worker described how every bus ride home felt like watching money disappear each trip meant carefully weighing what she could afford to spend. These constant calculations don’t just shape financial decisions; they affect mental and physical health too.

Research published in Science (Mani et al., 2013) found that financial stress reduces cognitive bandwidth, making decision-making harder. In one study, farmers struggling with financial strain performed significantly worse on cognitive tests than when they were financially stable equivalent to the effects of losing an entire night’s sleep.

Over time, chronic financial stress can lead to serious health risks hypertension, cardiovascular disease, and sleep disorders—affecting both personal wellbeing and the ability to focus at work.

Beyond its impact on health, financial stress directly affects workplace performance. A PwC (2023) study found that one in five employees reported that financial concerns impacted their productivity, with nearly half of financially distracted employees losing at least three work hours per week to dealing with money-related issues. Over a year, this adds up to nearly a full month of lost workdays per employee.

Bridging the Gap: What Can Workplaces Do?

For blue-collar workers, the inability to access cash when needed is one of the most common reasons that leads to financial stress. Even workers with stable wages often struggle to cover unexpected expenses because their income is locked into rigid pay cycles.

As a part of our survey from our project on Financial diaries, where we help women workers track their daily cash inflows and outflows, we are gaining valuable insights into their financial lives. We found that 85% of transactions by women garment workers are still in cash, and only 9% were UPI transactions with limited engagement in formal banking services. More than 60% of loans taken were from informal sources—friends, family, or moneylenders—often at high social or financial costs.

This reliance on informal credit makes financial stability fragile. Expenses like medical emergencies, school fees, rent can trigger a borrowing cycle that’s difficult to break.

Efforts to increase financial inclusion such as opening bank accounts or promoting digital transactions—have made progress. But access alone doesn’t solve the problem.

The Global Findex Database (World Bank, 2021) found that while women in developing countries are increasingly likely to own bank accounts, they are far less likely to control their finances independently. Household power dynamics, societal norms, and a lack of confidence in financial tools mean that access doesn’t always lead to actual usage.

This is where workplaces can make a difference.

Some workplaces have started offering employer-enabled Digital Financial Services (DFS) mobile banking access, financial literacy programs, and on-site digital tools. These services help workers, especially women, gain financial access, digital literacy, and trust in formal banking.

But DFS alone isn’t enough. A major limitation of DFS is that it does not solve workers’ immediate liquidity needs. Digital savings tools and mobile banking platforms may improve financial inclusion in the long run, but they don’t help when a worker needs money for rent or a medical emergency today.

The assumption that financial literacy and digital banking access will lead to solutions to financial stress ignores the importance of timing. Workers need financial flexibility not just in where they store their money, but in when they can use it.

Earned Wage Access (EWA)

Earned Wage Access (EWA) has the potential to bridge a critical gap. Our interest free intervention allows workers to access their earned wages before the pay day through a simple, android-based application via a tablet at the workplace enabling direct transfers to their bank account in just a few clicks. While DFS solutions focus on financial management, EWA directly addresses liquidity constraints by allowing workers to access their earned wages before payday.

Our study on EWA in the garment sector found that access to on-demand wages led to:

- A 33% reduction in informal borrowing

- A 20% decrease in forgone essential expenses

- An 8% increase in productivity

- A 21% lower attrition rates

The significance of EWA goes beyond numbers. It changes how financial security is understood in the workplace. Rather than seeing financial struggles as something workers must manage alone, EWA positions financial stability as a shared responsibility between employers and employees.

Just as wages, health benefits, and safe working conditions shape a worker’s quality of life, so does financial stability. The ability to cover daily expenses without stress, plan for the future, and avoid cycles of debt are not just personal concerns. They affect how workers show up, how they perform, and whether they stay in their jobs.

When workers aren’t constantly worried about making ends meet, they have the space to think beyond immediate survival. They can plan ahead, make more confident decisions at home and at work, and feel more in control of their future rather than constantly managing crises. In turn, businesses benefit from a more engaged, reliable workforce one that is not only present but able to thrive and contribute more meaningfully

References:

- PwC (2023). Employee Financial Wellness Survey. PwC

- Mani, A., Mullainathan, S., Shafir, E., & Zhao, J. (2013). Poverty Impedes Cognitive Function. Science, 341(6149), 976–980. DOI: 10.1126/science.1238041

- World Bank (2021). Global Findex Database. World Bank

- ScienceDirect (2024). Financial Scarcity and Cognitive Performance: A Meta-Analysis. ScienceDirect